Market Capsule 11th August '24 | Volatile Week ends on a Positive Note | Pharma Outperforms

- samarwealth

- Aug 11, 2024

- 6 min read

Domestic equity benchmarks fell for the second week in a row due to a global market rout, with declines in three out of five trading sessions. However, key indices saw strong gains on Friday, with the S&P BSE Sensex rising 819.69 points or 1.04% to 79,705.91, and the Nifty 50 index up 250.50 points or 1.04% to 24,367.50.

Pharma Sector has been a star performer in the recent volatility and has touched an All time high for the second straight week with names like Lupin, Sunpharma, Aurobindo pharma leading the charge.

The crisis in Bangladesh, a major market for Indian yarn, may affect USD 1.3 billion in exports, reducing realizations and margins. It could also offer opportunities for Indian fabric and garment manufacturers. Bangladesh's textile sector might see a 15-20% drop in RMG exports, potentially benefiting Indian exporters. Indian FMCG companies could face challenges like supply chain disruptions and increased costs.

Charting the Pulse of Indices:

A) Sector Wise Performance

B) Heatmap

Heatmap helps investors quickly understand the performance of multiple stocks or sectors in a single view. Color coding, with varying shades indicating the degree of movement - red for declines, green for gains, and sometimes grey or other colors for little or no change. Heatmaps are effective for spotting market patterns and can be a time-saving resource in investment analysis.

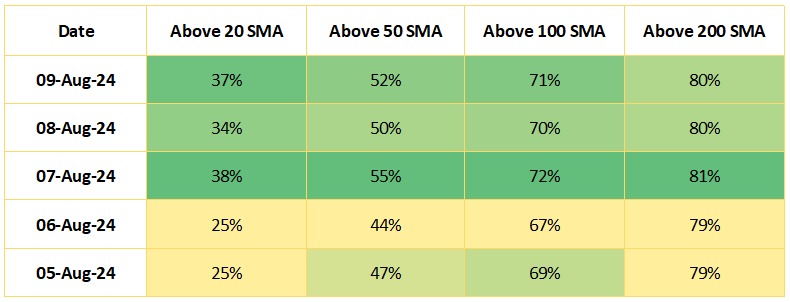

C) Market Breadth

A) Nifty 500

Analyzing market breadth is important as it provides insight into the underlying strength or weakness of the market, beyond just looking at benchmark indices. Breadth measures the percentage of securities in NIFTY 500 surpassing specified moving averages over the specified period. Comparing the market breadth of nifty 500 during the previous week's trading sessions, we can analyze that number of stocks above key moving average support areas are reducing by the end of week. This can be considered as a sign of weakness if change is seen to be significant.

Blockbuster Results

Sandur Manganese & Iron Ores Ltd. reported robust Q1FY25 results, with revenue rising 66% YoY to ₹602 Cr, an OPM of 32%, and PAT soaring 265% YoY to ₹146 Cr.

Paras Defence and Space Technologies Ltd. announced strong Q1FY25 results, with revenue increasing 73% YoY to ₹84 Cr, an OPM of 29%, and PAT rising 133% YoY to ₹14 Cr.

Tiger Logistics (India) Ltd. reported impressive Q1FY25 results, with revenue surging 141% YoY to ₹101.16 Cr, an OPM of 5.11%, and PAT growing 120% YoY to ₹4.63 Cr.

Symphony Ltd. reported robust Q1FY25 results, with revenue up 76% YoY to ₹531 Cr, an OPM of 21%, and PAT soaring 267% YoY to ₹88 Cr.

Dolat Algotech Ltd. reported impressive Q1FY25 results, with revenue up 244% YoY to ₹123 Cr, an OPM of 80%, and PAT soaring 454% YoY to ₹72 Cr.

Sky Gold Ltd. reported Q1FY25 with 92.4% YoY revenue growth to ₹723 Cr, EBITDA up 100% to ₹37.3 Cr, PAT rising 98.9% to ₹21.2 Cr, and sales volumes at 349 kg/month, with profits doubling YoY.

Inox Wind Ltd. reported strong Q1FY25 results, with revenue up 83% YoY to ₹639 Cr, an OPM of 21%, and PAT turning positive to ₹50 Cr from a loss of ₹65 Cr.

Good Results:

Osia Hyper Retail Ltd. achieved 58% YoY revenue growth to ₹324.65 Cr in Q1FY25, with an OPM of 21% and PAT rising 81% to ₹6.69 Cr.

BLS International Services Ltd. reported 28.5% YoY revenue growth to ₹492.7 Cr in Q1FY25, with an OPM of 27% and PAT up 70% to ₹121 Cr.

Refex Industries Ltd. posted 56% YoY revenue growth to ₹595 Cr in Q1FY25, with an OPM of 8% and PAT increasing 39% to ₹29 Cr.

Schneider Electric Infrastructure Ltd. reported 19.72% YoY revenue growth to ₹593 Cr in Q1FY25, with an OPM of 14% and PAT rising 37% to ₹48 Cr.

Devyani International Ltd. reported 44.33% YoY revenue growth to ₹1,222 Cr in Q1FY25, with an OPM of 18% and PAT turning positive to ₹22 Cr from a loss of ₹2 Cr.

ITD Cementation India Ltd. reported 30% YoY revenue growth to ₹2,381 Cr in Q1FY25, with EBITDA rising 36% to ₹237 Cr and PAT increasing 91% to ₹100 Cr.

1. Shaily Engineering Plastics Ltd

2. AWFIS Space Solutions Ltd

3. ITC Ltd

4. India Glycols Ltd

Corporate Developments

Order Wins:

Insolation Green Infra Pvt Ltd has partnered with Ganesh Décor India Pvt Ltd for a solar power project in Rajasthan, totaling 27.38 MW (AC)/35.60 MW (DC) with an estimated value of Rs. 142.40 crore. Link

South West Pinnacle Exploration Ltd. has won three contracts worth Rs. 49.52 crore from the Central Ground Water Board for projects in Madhya Pradesh and Chhattisgarh. Link

Power Mech Projects Ltd has secured an Rs. 110.57 crore order for the operation and maintenance of a 400 MW captive power plant and utilities at the Dangote Petroleum Oil Refinery in Nigeria. Link

GE T&D India Limited has secured an order worth ₹305 crore from Power Grid Corporation of India Limited. Link

MTAR Technologies Ltd has secured export orders valued at approximately USD 16.73 million (around ₹140 crores). Link

Goldiam International Ltd received its largest export order ever, worth Rs. 50 crores, for lab-grown diamond studded gold jewelry from a major U.S. retailer. Link

Ceigall India Ltd has been declared the H-1 bidder for the ₹143 crore project to develop the Kanpur Central bus terminal on a DBFOT basis by Uttar Pradesh State Road Transport. Link

NBCC (India) Ltd has received a work order worth approximately Rs. 15,000 crore from the Srinagar Development Authority. Link

Share Splits/Bonus Issue:

Jamshri Realty Ltd has scheduled a stock split for 9th August, 2024 reducing the face value of its shares from ₹1000 to ₹10. Link

Milkfood Ltd has announced a bonus Issue with a record date set for 13th August, 2024, to be issued in a 1:1 ratio. link

EIH Associated Hotels Ltd has announced a bonus Issue with a record date set for 13th August, 2024, to be issued in a 1:1 ratio. link

GRP Ltd has announced a bonus issue in a 3:1 ratio, with the record date set for August 12th, 2024. link

Memorandum of Agreement/Agreements:

Eco Hotels and Resorts Limited signed a deal to open a 94 rooms hotel in Sindhudurg, Maharashtra. Link

Taneja Aerospace and Aviation Limited (TAAL) has entered into Shareholder’s cum Investment Agreement with Zenith Precision Private Limited.. Link

Metro Brands Ltd. has signed a long-term exclusive deal with New Era Cap Co. Ltd. to distribute and sell its products like caps, hats, apparel, and accessories across India via kiosks, stores, and other channels. Link

Block/Bulk Deals:

Akums Drugs & Pharmaceuticals Ltd: Small Cap World Fund Inc bought 25,86,541 shares @ ₹754

Sapphire Foods India Ltd: Kotak Mahindra Mutual Fund bought 5,99,250 shares @ ₹1650

Protean eGov Technologies Ltd: Standard Chartered Bank sold 12,50,000 shares @ ₹1800

Acquisitions & Mergers:

Lumax Industries Ltd will invest up to Rs. 3.47 crores to acquire up to a 49% stake in Clean Max Nabia Private Limited. Link

Tata Power Ltd plans to acquire a 40% stake in Khorlochhu Hydro Power Limited in one or more tranches, pending a Share Purchase Agreement. Link

Bansal Wire Industries Ltd approved the acquisition of 65,57,790 equity shares, representing a 23.85% stake, from existing shareholders of M/s Bansal Steel & Power Limited. Link

Exicom Tele-Systems Limited approved an investment of up to Rs. 470 crores in its wholly-owned Netherlands subsidiary, Exicom Power Solutions B.V.,in one or more tranches Link

Joint Venture:

Other Important News:

That's all for now! I hope you enjoyed the content. Do share your comments below! Disclaimer: Any stock or company discussed above should not be considered as a Buy/Sell recommendation. We personally or our clients might or might not have a position in any of the stocks discussed. This newsletter is purely is for educational purposes only.

Comments